Did the pandemic cause you to dip into your retirement nest egg to pay for emergency expenses? We compiled a list of good savings strategies to help get you through a tough time. Use our ten tips to get back on track and help rebuild your savings for retirement.

We often forget simple lessons about money we learned a long time ago. This includes the time value of money. Money you save today even at a low, compounding interest rate can mean a lot for your retirement down the road.

This information is subject to change.

Annuities are long-term insurance contracts and are not FDIC insured. Early withdrawals may be subject to penalties and taxes. Rates and guarantees are based on the claims-paying ability of the issuing company.

If you are over 55, a fixed annuity, or multi-year guaranteed annuity (MYGA) offers guaranteed rates for fixed periods of time. Annuity rates can be higher than other products at similar durations. Learn about Nassau's single premium deferred fixed annuity.

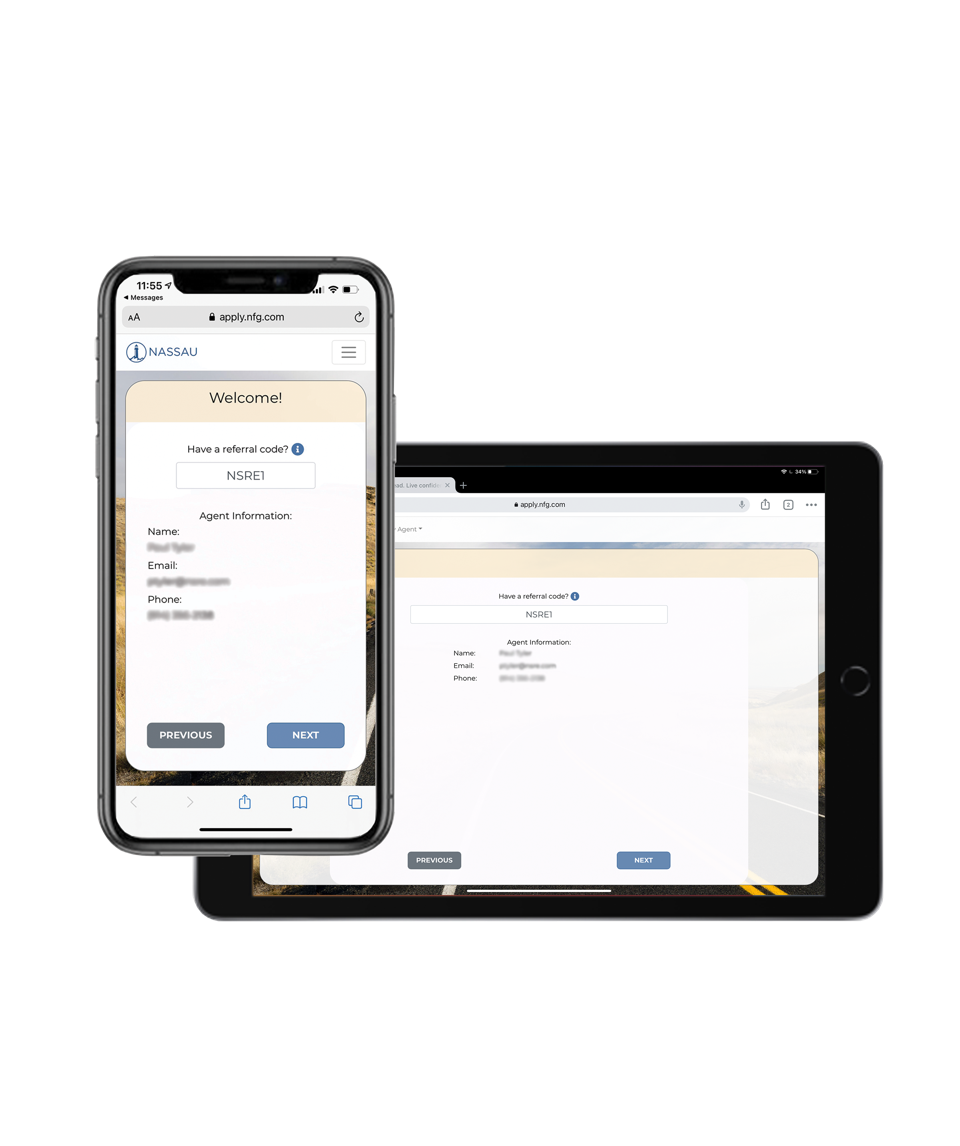

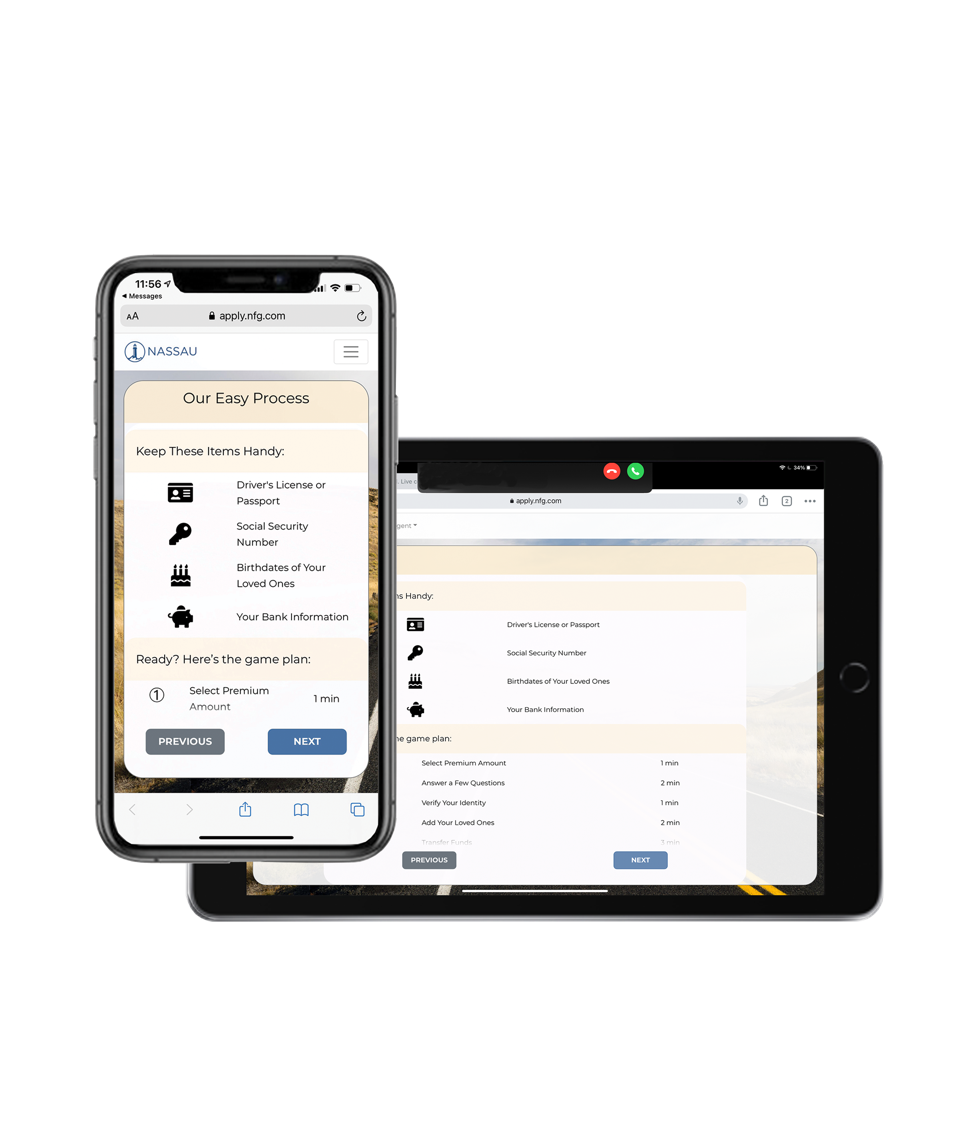

Track the interest rate environment, take courses, and learn about different savings and fixed annuity options. You can also purchase a Nassau deferred fixed annuity through our user friendly mobile site. Work with your independent insurance agent/producer to make the right decisions for you.

Work with your independent insurance agent. Learn how.

Illustration only. Rates may vary.

Work with your independent insurance agent.

Don't have an agent? We’re happy to help you find an independent agent/producer in your area.

It’s great to save money and earn interest. It’s even better to build a personal program that continually builds your savings, returns good rates, but also offers some liquidity. Some people call this strategy "laddering". We call it learning good, solid savings habits and putting them to work.

We offer a number of free, online courses that cover everything from basic savings concepts to how our insurance products actually work. We add new courses to our list. Enroll today.

Important Disclosures

Financial calculators and calculations are for educational and illustrative purposes only. Nassau makes no representations as to the accuracy or suitability of the information provided. You are encouraged to speak to a financial professional before making any insurance, investment or financial planning decisions.

Annuity contracts may be subject to possible loss of principal and earnings, since a surrender charge and market value adjustment may apply to withdrawals or upon surrender of the contract.

Annuities are long-term contracts. Annuities held within qualified plans do not provide any additional tax benefit. With certain exceptions, surrender charges apply to withdrawals taken during the initial guarantee period and a market value adjustment, which may increase or decrease the amount received upon withdrawal, may also apply at any time.

All or a portion of amounts withdrawn are subject to ordinary income tax, and if taken prior to age 59 1⁄2, a 10% IRS penalty may also apply. Nassau does not provide tax, financial or investment advice, or act as a fiduciary in the sale or service of the product. Consult a tax advisor or financial representative about your specific circumstances.

The information above is intended for use by the general public and is not individualized to address any specific investment objective. It is not intended as investment, tax or financial advice. We encourage you to consult with an advisor who can tailor a financial plan to meet your needs.

Nassau does not provide investment or financial advice or act as a fiduciary in the sale or service of its products.

Product features, options and availability may vary by state. Guarantees are based on the claims-paying ability of the issuing company.

Nassau Single Premium Deferred Fixed Annuities (18FADTCP and ICC18FADTCP) are issued by Nassau Life and Annuity Company (Hartford, CT). In New York, annuities (Form 17IMGA) are issued by Nassau Life Insurance Company (East Greenbush, NY). Nassau Life and Annuity Company is not authorized to conduct business in ME and NY, but that is subject to change. Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible only for its own financial condition and contractual obligations.

Insurance Products: NOT FDIC or NCUAA Insured, NO Bank or Credit Union Guarantee

This is a brief description of Nassau Simple Annuity and is meant for informational purposes only. Please refer to your Contract for any other specific information including limitations, exclusions and charges.